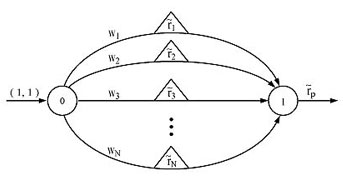

Complex financial decisions can be modeled using network flow diagrams that include uncertainty. The solutions to these models find optimal risk adjusted solutions to long-term investment situations. The Theory of Portfolio Networks is presented in Professor Jones’ comprehensive textbook and is introduced in the Blog page here.

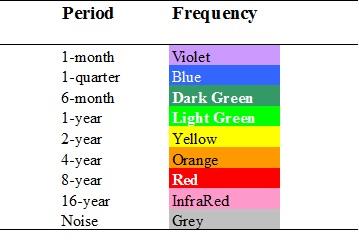

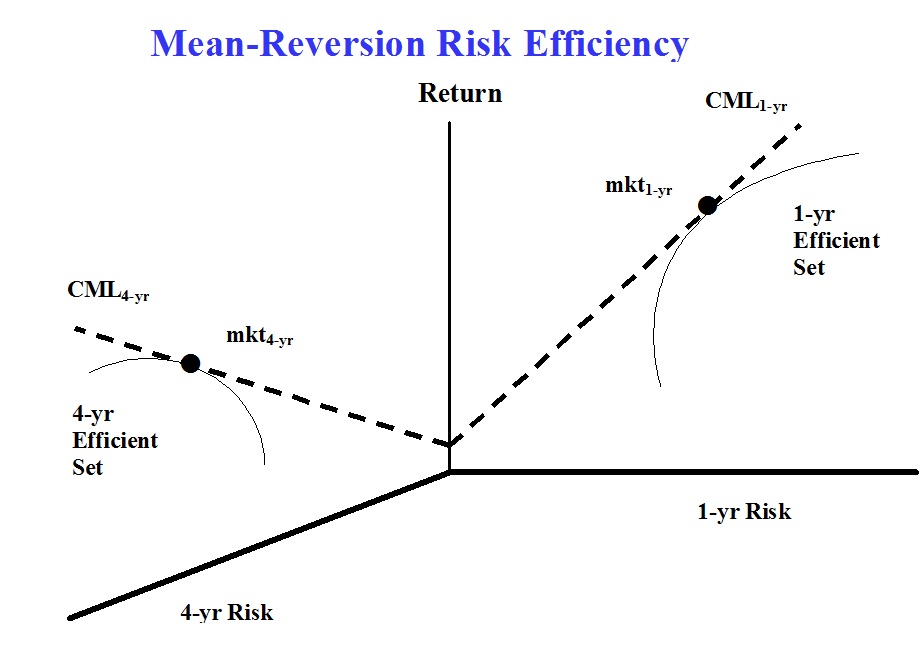

Digital Portfolio Theory controls long-term portfolio risk using a digital signal processing representation of risk. The solution is a linear model that uses multiple single period solutions to find optimal long-term asset allocations. Optimal portfolios depend on mean-reversion risk and holding period. See examples and the Digital Portfolio and the Research page.

Horizon Based Asset Pricing Models

Digital Portfolio Theory implies multi-dimensional capital market equilibrium. Mean-reversion risk efficiency is found independently in multiple length dimensions. Multiple mean-reversion Betas describe the equilibrium relationship between mean-reversion risks and return. The autocovariance-CAPM, or calendar CAPM is found in the Book and Research pages.

What we Offer

Portfolio Networks offers investors a long-term portfolio optimization model for the first time. The same stability and reliability achieved in digital communications and the internet is now available for the investor. Volatility models such as modern portfolio theory, arbitrage pricing theory and the option pricing theory are useful to traders and short-term investors. Digital Portfolio Theory benefits both small and large long-term investors using digital signal processing technology.

View Services →

About Us

Portfolio Selection Systems (PSS) publishes a state of the art portfolio selection software package PSS Release 2.0: Digital Portfolio Theory. PSS gives the investor the ability to efficiently achieve market timing and optimal diversification by applying digital signal processing to the classical Modern Portfolio Theory portfolio selection problem. The application of the mathematics of digital signal processing to financial network theory has resulted in a revolutionary new approach to risk management and portfolio selection. The addition of a time dimension to risk, allows memory to be included in the investment model. The PSS software package enables the user to find optimal diversified portfolios of investments based on systematic, unsystematic, calendar and non-calendar risk. Not only is PSS the most sophisticated large scale portfolio optimization software but it also performs fundamental analysis as well. The software does not do any form of technical analysis or forecasting. The software package utilizes digital signal processing technology to measure the risk of calendar and long memory effects. Calendar and non-calendar risk are used to solve the Digital Portfolio Theory model. The Digital Portfolio Theory model is presented in the PSS User’s Guide. The PSS Release 2.0 software package makes the benefit of this new theory available to the average investor.

Also available from PSS is the textbook, Portfolio Management, by the same author as the software package. The book gives an in depth treatment of the theoretical model used in the software package. It presents the theoretical transformation of financial theory using signal processing to describe risk. The stochastic generalized portfolio network model derived in the book creates a unified field of financial risk management and portfolio optimization. A complete derivation of Digital Portfolio Theory is available in the book Portfolio Management published by McGraw-Hill in 1992.

Frequently Asked Questions

How can Portfolio Networks benefit me?

By describing long-term complex financial situations as portfolio networks optimal solutions can be easily found.

How can Digital Portfolio Theory improve my investment performance?

By quantifying for the first time, the risks of mean-reversion in security returns, investors can find more efficient portfolios that reflect their holding periods.

How will Digital Portfolio Theory change financial economics?

The horizon based asset pricing model offers a much more concise description of risks that can be applied in all other financial models.

Why Choose Us?

Comprehensive

The theory of portfolio networks presented in the book gives a powerful new financial modeling framework that incorporates risk, return, and time.

Inclusive

The digital signal processing description of risk allows stable and reliable financial products and positions to be constructed

Professional

The network description of investments and the signal processing description of risk allow a higher level of financial planning.

Testimonials

Here’s what just some of our supporters have said

‘Professor Jones’ network modeling of financial analysis is likely to attract strong adherents’.

Harry Markowitz

1990 Noble Prize in Economics

‘The application of network models to portfolio planning is an area with exciting possibilities and this book fills a current void.’

Mark Broadie

Columbia University

‘Digital Portfolio Theory is derived by applying digital technology to Modern Portfolio Theory.’

C. Kenneth Jones

AMOCO Professor of Management

Blog

Compatibility

Request a Call Back

Would you like to speak to one of our consultants over the phone? Just submit your details and we’ll be in touch shortly. You can also email us if you would prefer.