The advantage of the portfolio network model lies with several factors. The portfolio network model gives a more understandable conceptual framework through the use of visual diagrams of portfolio structure. The ability to visualize a problem not only enhances understanding but allows extension to problems not even imaged previously. Secondly, the network […]

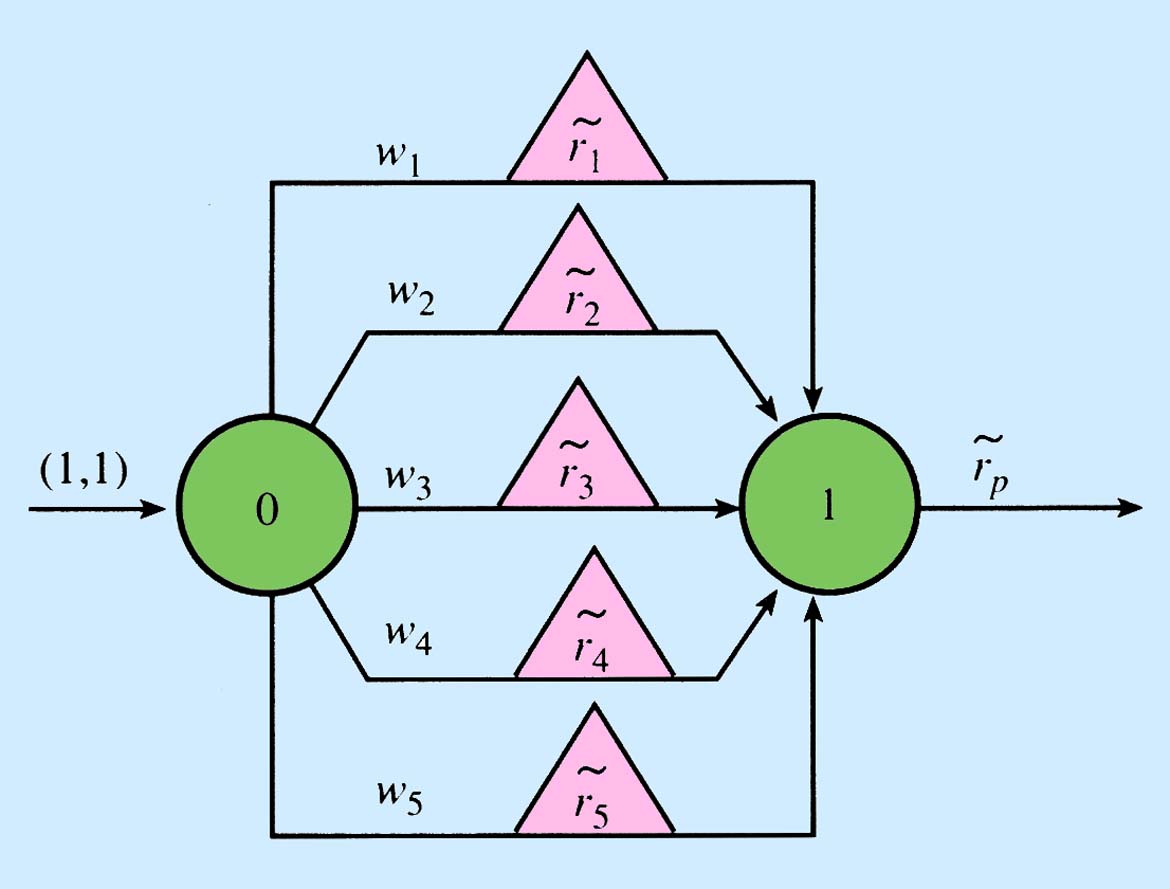

One Period Stochastic Portfolio Network with Uncertain Returns

representation not only helps describe the relationship between decision variables, it also facilitates the definition of the appropriate decision model. Finally extremely efficient solutions methods have been developed for solving these network formulations. New solutions techniques permit the resolutions of portfolio problems involving thousands, millions, or even billions of variables. It is not inconceivable that optimal solutions can be found for economy-wide models. The theory of portfolio networks as presented in the Book is divided into two parts; deterministic portfolio networks, and stochastic portfolio networks. Deterministic portfolio networks examine problems with monetary flows and returns that are assumed to be know with certainly. Stochastic portfolio network models assume that cash flows and returns follow probability distributions and are therefore uncertain at future points in time.